The Power of Time in the Housing Market

You’ve probably heard the phrase: “Yesterday was the best time to buy a home, but the next best time is today.” That’s because time in the housing market – not timing it – is what truly builds long-term wealth. While many hopeful buyers are holding out for prices to fall or interest rates to improve, experts agree: waiting could cost you more than you think.

The reality is that trying to time the market rarely works. What matters most is getting in – because time in the housing market allows your investment to grow steadily over the years. With home prices expected to rise through at least 2029, buying sooner rather than later can be a smart financial move.

Forecasts Say Prices Will Keep Climbing

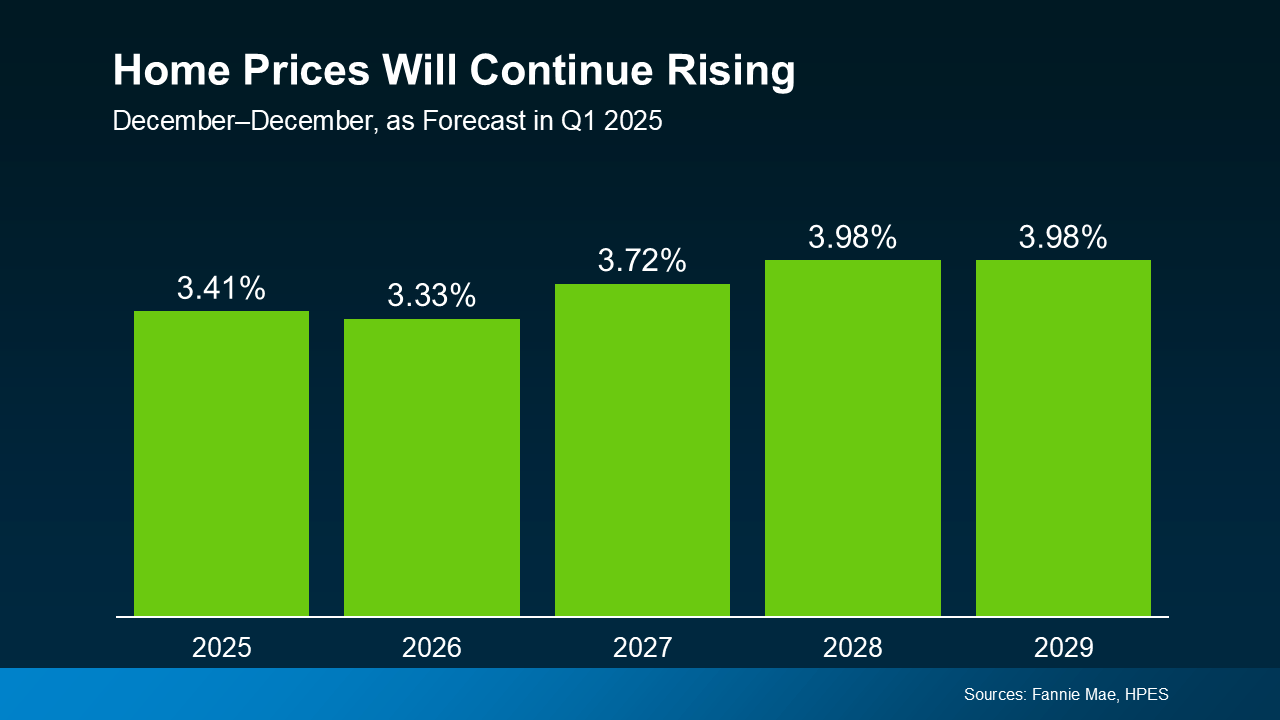

Each quarter, over 100 housing market experts weigh in for the Home Price Expectations Survey from Fannie Mae, and they consistently agree on one thing: nationally, home prices are expected to rise through at least 2029.

Yes, the sharp price increases are behind us, but experts project a steady, healthy, and sustainable increase of 3-4% per year going forward. And while this will vary by local market from year to year, the good news is, this is a much more normal pace – a welcome sign for the housing market and hopeful buyers (see graph below):

And even in markets experiencing more modest price growth or slight short-term declines, the long game of homeownership wins over time.

So, here’s what to keep in mind:

- Next year’s home prices will be higher than this year’s. The longer you wait, the more the purchase price will go up.

- Waiting for the perfect mortgage rate or a price drop may backfire. Even if rates dip slightly, projected home price growth could still make waiting more expensive overall.

- Buying now means building equity sooner. When you play the long game of homeownership, your equity rewards you over time.

What You’ll Miss Out On

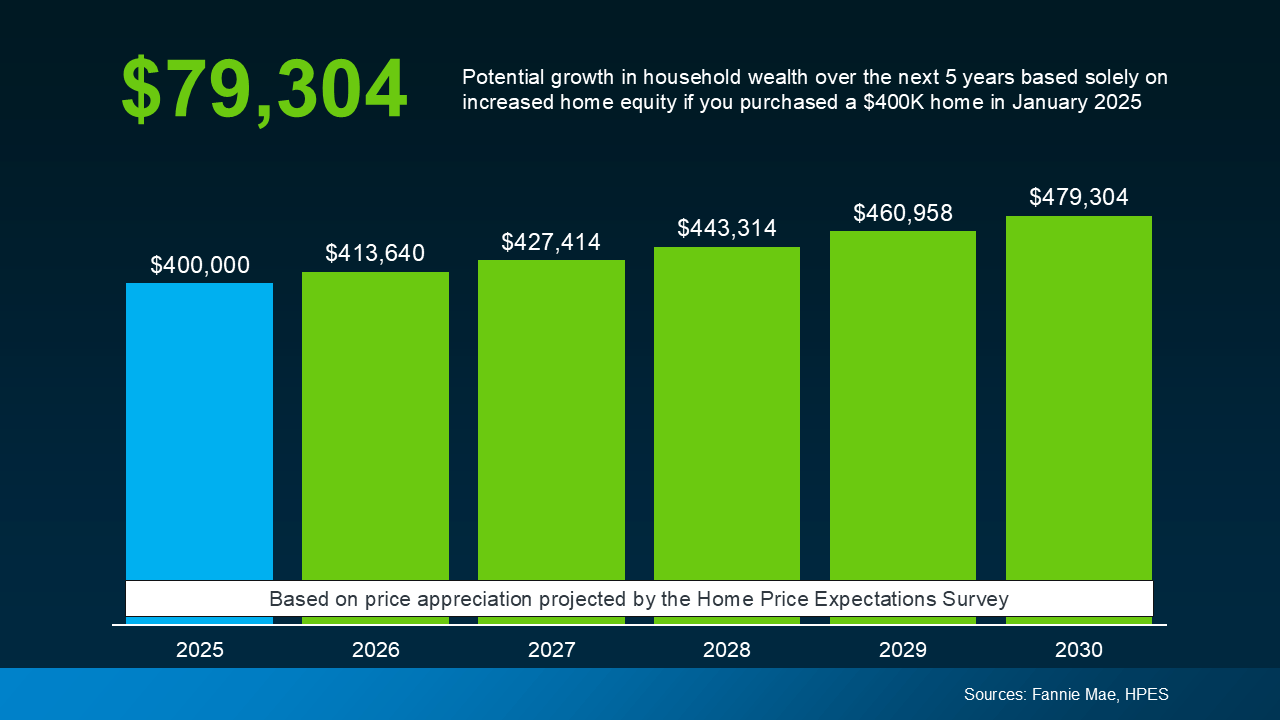

Let’s put real numbers into this equation, because it adds up quickly. Based on those expert projections, if you bought a typical $400,000 home in 2025, it could gain nearly $80,000 in value by 2030 (see graph below):

That’s a serious boost to your future wealth – and why your friends and family who already bought a home are so glad they did. Time in the market matters.

That’s a serious boost to your future wealth – and why your friends and family who already bought a home are so glad they did. Time in the market matters.

So, the question isn’t: should I wait? It’s really: can I afford to buy now? Because if you can stretch a little or you’re willing to buy something a bit smaller just to get your foot in the door, this is why it’ll be worth it.

Yes, today’s housing market has challenges, but there are ways to make it work, like exploring different neighborhoods, asking your lender about alternative financing, or tapping into down payment assistance programs.

The key is making a move when it makes sense for you, rather than waiting for a perfect scenario that may never arrive.

Bottom Line

Time in the Market Beats Timing the Market.

If you’re debating whether to buy now or wait, remember this: real estate rewards those who get in the market, not those who try to time it perfectly.

Want to take a look at what’s happening with prices in our local area? Whether you’re ready to buy now or just exploring your options, having a plan in place can set you up for long-term success. Contact me with questions about our local market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link