Mortgage Rates in Denver: What You Need to Know about Fed Cuts

The Federal Reserve (the Fed) meets this week, and expectations are high that they’ll cut the Federal Funds Rate. But what does that mean for mortgage rates in Denver? Many people assume mortgage rates fall immediately after the Fed acts, but the truth is more nuanced. Let’s clear up the confusion and connect it to the local real estate market.

When interest rates climbed sharply in 2022, Denver’s once red-hot housing market cooled. Higher borrowing costs forced many buyers out of the market, inventory sat longer, and price appreciation slowed compared to the record highs of 2020–2021. Since then, Denver real estate has remained competitive but more balanced, with affordability challenges still holding back some buyers.

Now, with the Fed expected to begin a rate-cutting cycle, the big question is: what happens to mortgage rates in Denver and how will that shape the market for both buyers and sellers?

The Fed Doesn’t Directly Set Mortgage Rates

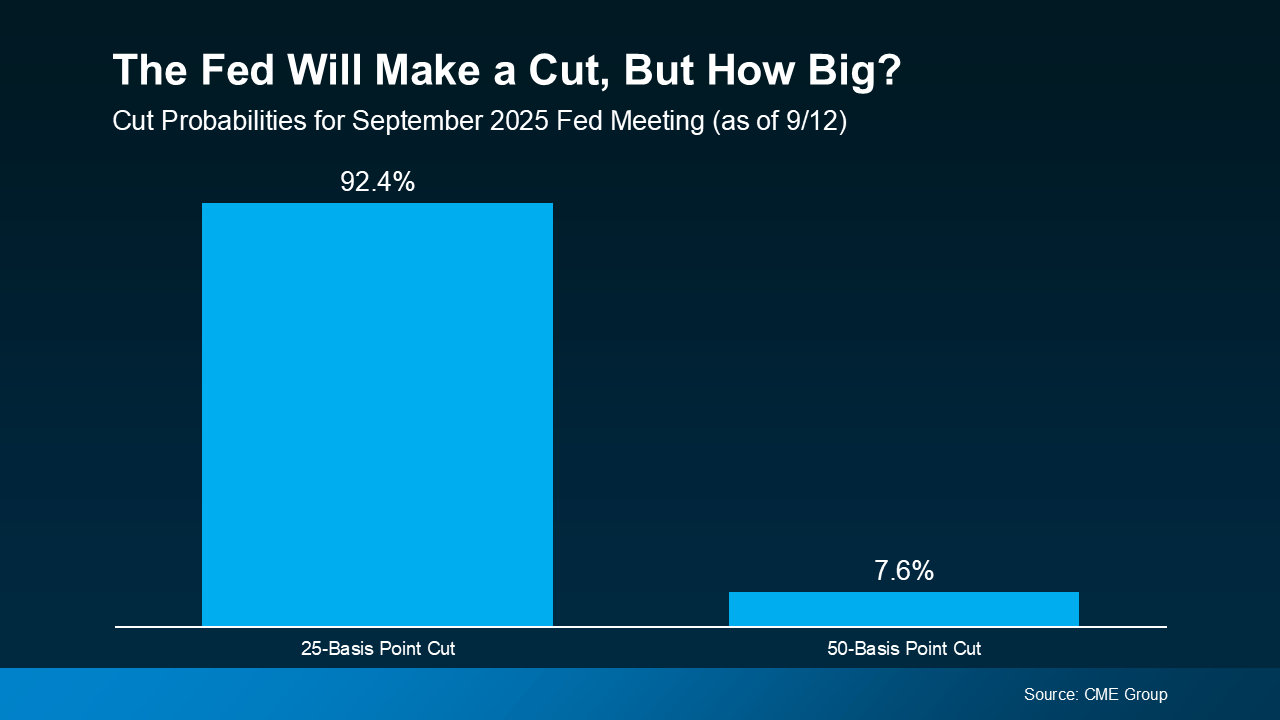

Right now, all eyes are on the Fed. Most economists expect a cut to the Federal Funds Rate in mid-September to prevent a potential recession. According to the CME FedWatch Tool, markets are already pricing in the move.

The important distinction is that the Federal Funds Rate is the short-term rate banks charge each other—not mortgage rates. However, Fed actions strongly influence the direction mortgage rates take. In Denver, that means the timing of Fed cuts could shift affordability for thousands of homebuyers waiting on the sidelines.

Why Mortgage Rates May Already Reflect the Fed’s Move

Mortgage rates often adjust based on what markets expect the Fed to do, not the action itself. That’s why after weaker-than-expected job reports earlier this year, mortgage rates began to ease ahead of the Fed’s September meeting.

If the Fed cuts by 25 basis points, much of that is already factored into current rates. A larger 50-point cut, however, could create a more noticeable drop, offering Denver buyers more purchasing power.

What Lower Mortgage Rates Could Mean for Denver’s Market

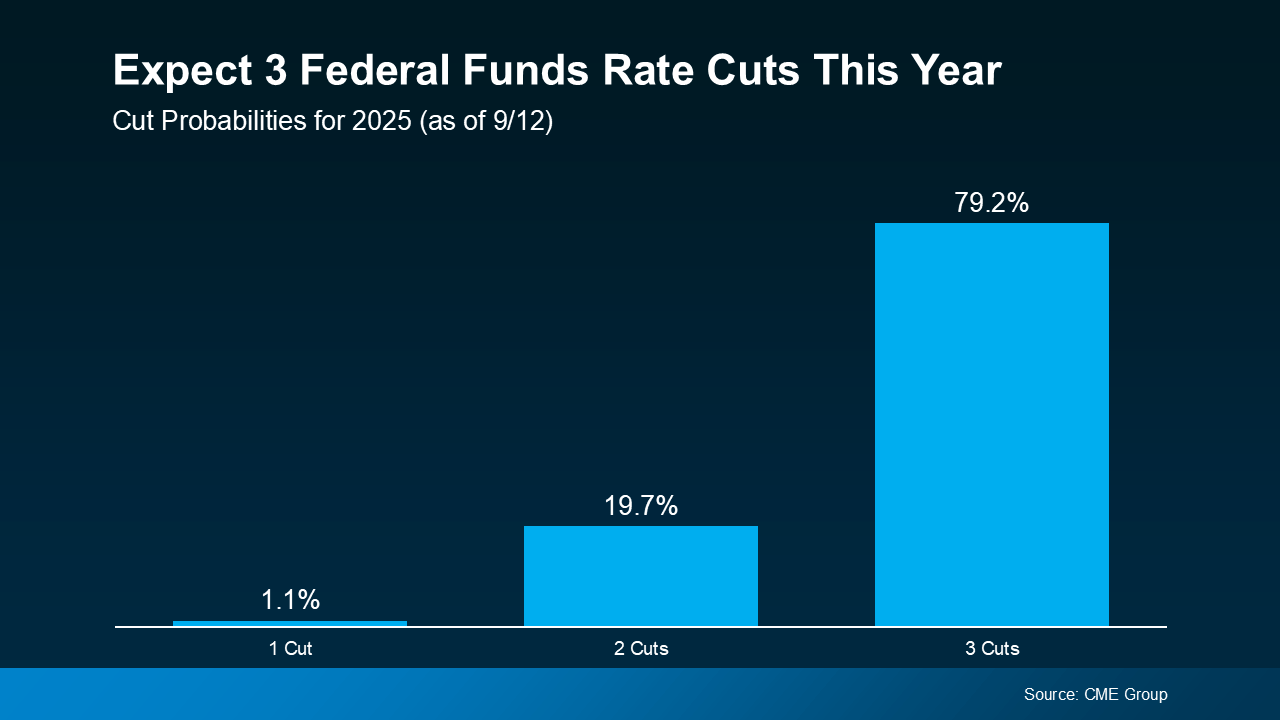

If rate cuts continue through late 2025, borrowing costs could trend downward, easing affordability issues that have weighed on Denver’s housing market. That could bring more buyers back, reigniting demand and competition.

For sellers, falling mortgage rates may translate into stronger offers and quicker sales. For buyers, the window before demand fully rebounds could be the best chance to secure a home at a less frenzied pace.

As Sam Williamson, Senior Economist at First American, explains:

“For mortgage rates, investor confidence in a forthcoming rate-cutting cycle could help push borrowing costs lower in the back half of 2025, offering some relief to housing affordability and potentially helping to boost buyer demand and overall market activity.”

Bottom Line

Mortgage rates won’t move in lockstep with Fed cuts, but the overall trend suggests they could ease later this year and into 2026. In Denver, that shift could make a big difference. Buyers may see renewed affordability, while sellers could benefit from rising demand.

If you’re considering making a move in Denver, now is the time to discuss strategy. Even small changes in mortgage rates can significantly affect affordability, and being prepared ensures you make the most of the opportunities ahead. Let’s discuss your options.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link